STAR Scholars: Exploring the Long-Term Impact of Activist Investors on Shareholders

During the past decade, there has been an increase in shareholder activism, which has also attracted much controversy. Bill Ackman, an American hedge-fund manager, is also a famous activist investor who believes in the ability to improve the performance of a company. The majority of investors have no interest in being active and are therefore considered passive investors; people who have the ability to improve a company’s value but instead remain in a passive position.

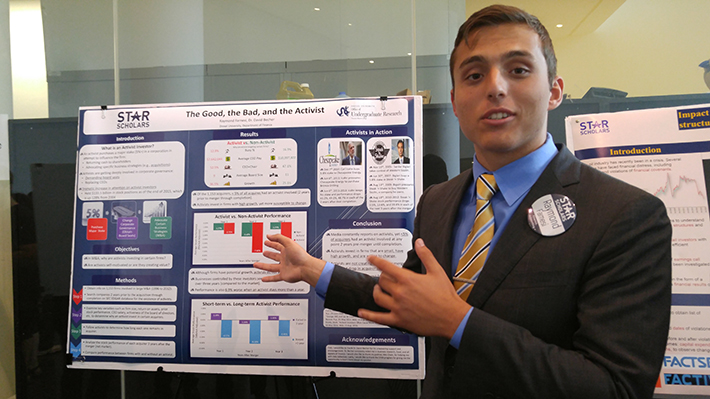

Shareholder activism peaked the interest of Drexel LeBow sophomore Raymond Farnesi this past summer. Farnesi participated in a research project as a part of Drexel’s Students Tackling Advanced Research (STAR) Scholar program.

Farnesi’s research investigated an activist investor’s ability to buy a large share of a company in an attempt to get a board seat, attend shareholder meetings, and influence management. Farnesi looked at activists who get involved with investing in a company two years before they merged the company.

Being a finance and economics dual major, he was particularly inquisitive about stock performance in a company with activist investors. “I wanted to know what happens to the stock of a company and what happens to company performance when activists get involved,” says Farnesi.

The STAR Scholar examined 1,200 acquirers in large mergers between 1996 and 2012. He learned that activists target companies that are declining but have high growth potential, and aim at making a profit by changing up the companies’ management.

Farnesi learned that businesses that are controlled by activist investors actually do worse in the long run. “Businesses controlled by these investors see their stock drop by nearly 8 percent over three years (compared to the market) and perform 6.3 percent worse than firms that also did an acquisition without an activist,” says Farnesi.

Farnesi has been asked to continue his research and to execute more showcases surrounding his findings. Farnesi plans to continue his analysis of activist investors when he reaches the graduate level.

Farnesi worked with faculty mentor and associate professor of finance David Becher, PhD, who he credits as being the biggest influence he has had at Drexel. Farnesi says Becher was very helpful and patient with him and he is glad he got to work with him. “Having a mentor in the business world is so great; you can’t beat it,” says Farnesi.

Famesi became passionate about becoming a finance and economics major from the research he conducted over the summer. After STAR, he realized that this is the area of business he wants to be in.

He came to Drexel because of the co-op program. He says Drexel will give him the ability to have invaluable work experience. “It is one thing to study books, but it’s another to be in an actual work environment. The interpersonal skills are something you can’t teach,” says Farnesi.

As far as Farnesi’s goals for the future, he is not sure what field he wants to go into but he hopes to have a positive impact on the future company he works for and on the people around him. He says he does not want to be “the guy who is all about money,” but rather someone with integrity. “I want to keep level while doing well for myself,” says Farnesi.

Undergraduate research offers the opportunity to get to know faculty, explore a major area of research and gain practical research skills and experience.

The BSBA Finance major includes classes in economics, accounting, statistics and marketing, in addition to corporate finance, investment securities and more.

Our undergraduate programs engage students with multiple fields in economics while offering them the flexibility to pursue other areas of interest.