The Ability of the Most Financially Constrained Firms to Raise Capital During the COVID-19 Pandemic

By Michelle Lowry, PhD, and Teresa Harrison, PhD

In this second article of our multi-part series on capital raising during the pandemic, we examine differences in capital raised across publicly traded companies. As a follow-up to our previous piece in which we focused on nonprofits, here we focus on the approximately 3,000 public companies that trade on U.S. exchanges. These companies range from firms that have been public for less than one year to over 100 years and companies with assets less than $1 million to over $200 billion. The largest of these companies are household names, such as Apple, Microsoft and Walmart. In contrast, relatively few people would be familiar with most of the smaller companies. Some of these companies have benefited tremendously from the pandemic, like Amazon and Zoom, while others have seen their revenues plummet, like Delta Airlines and Royal Caribbean. Many of these companies are likely to need additional capital – in some cases to stay in business and in other cases to meet escalating demand. Discussions in the Boardroom should focus on the precise factors for which the company needs capital. Evidence suggests that capital is available to those companies who can demonstrate a need for it.

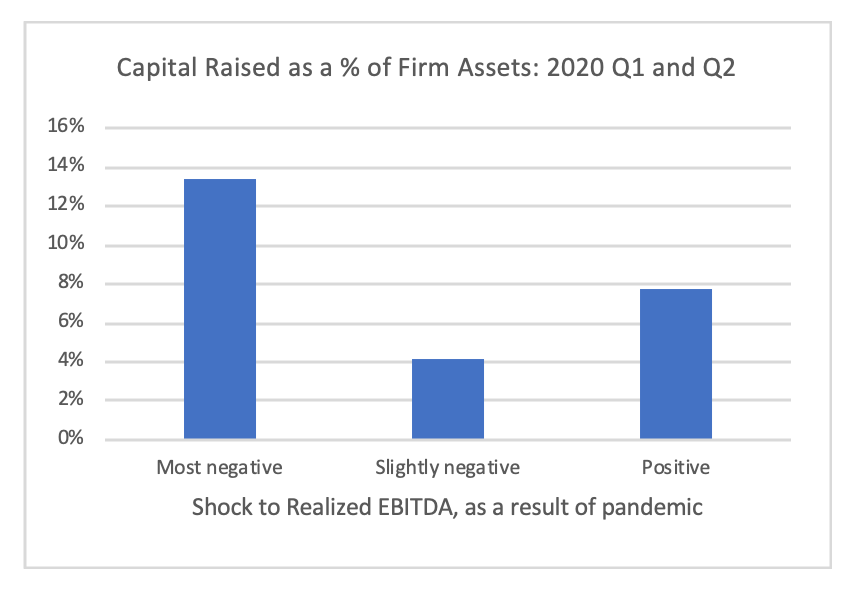

Recent research by Hotchkiss, Nini and Smith (2020) examines trends in capital raising, across these different types of companies, since the onset of the pandemic. The main takeaway is that two very different sets of companies both raised substantial amounts of capital during the first two quarters of 2020: companies hit hardest by the pandemic and companies that benefited most from the pandemic. These patterns are highlighted in the figure below.

Companies that experienced the most negative shock to EBITA, defined as annualized EBITA over the first two quarters of 2020 minus EBITA during 2019, are shown in the left-hand bar in the figure. These companies raised the most capital as a fraction of assets: 13%. The airline, cruise ship and retail industries are heavily represented in this set, for example companies such as Southwest Airlines, Delta Airlines, Carnival, Royal Caribbean and Starbucks. Among these companies, the additional capital represents a lifeline, as they focus on weathering the crisis.

Strikingly, companies that benefited most from the pandemic, defined as experiencing an increase in EBITA, also raised substantial amounts of capital as a fraction of assets: 8%. This category includes companies such as Zoom, Amazon, Hasbro and Moderna, among others. Among these companies, the additional capital facilitates company growth. It enables companies to fund new investment projects and to increase production to meet the higher demand for products and services.

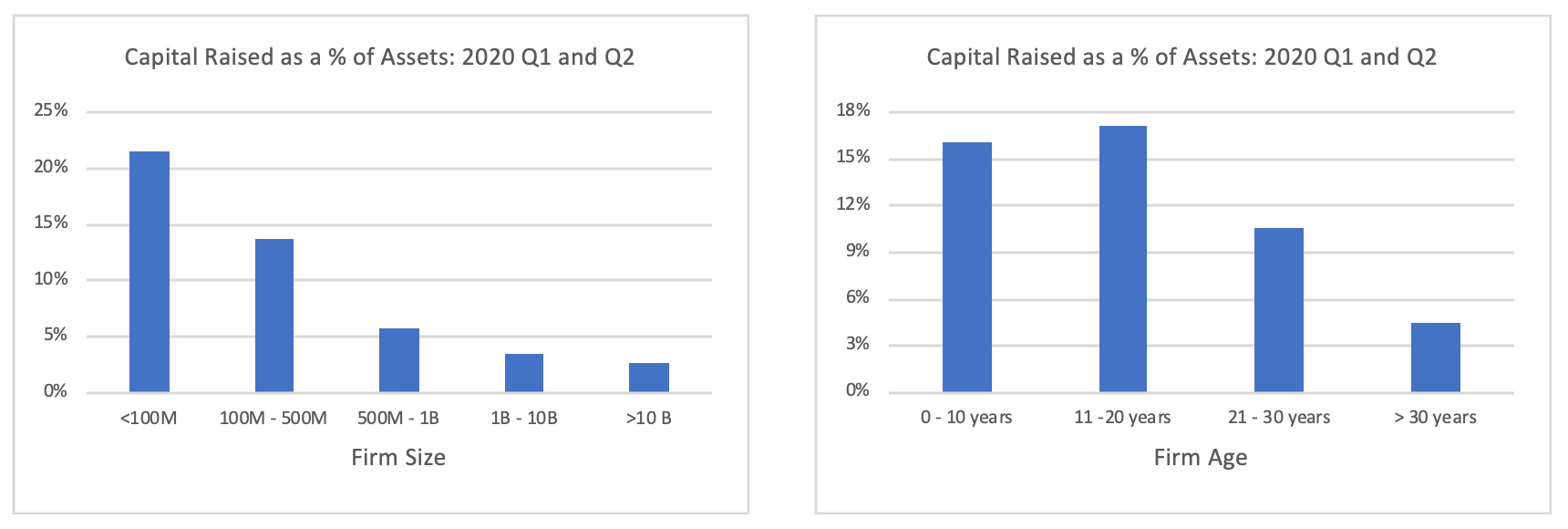

Further analysis investigates firms that are typically characterized as being more financially constrained – were such firms able to raise capital during this critical time? Evidence shows that smaller and younger firms, which are frequently characterized as being more financially constrained, have actually raised significantly more capital (as a fraction of assets) than their larger and older counterparts. As shown in the below graph, the smallest companies (defined as companies with less than $100 million in assets) raised capital equivalent to 21.6% of their assets in the first two quarters of 2020, compared to an analogous rate of only 3.5% for companies between $1 and $10 billion. In a similar vein, the youngest companies (defined as companies that have been publicly traded for less than 10 years) raised capital equal to 16.1% of their assets, compared to an analogous rate of only 4.5% for companies more than 30 years old.*

In sum, within the for-profit space, capital markets have provided substantial amounts of capital to publicly traded firms that have the highest demands for funds, irrespective of whether this demand stems from an effort to avoid distress or an effort to fund growth. Critically, this is not restricted to the larger firms in our economy. Rather, the smaller and younger firms, which academic literature typically characterizes as being more financially constrained, have raised the greatest amounts of capital (as a fraction of assets).

This evidence raises questions regarding the experiences of different types of organizations, for example in the non-profit space. Have non-profits that are in the most dire need of funds been able to obtain these funds? Our recent piece highlighted challenges that many non-profits face, in terms of both fundraising and access to endowments. Stay tuned for future pieces, in which we delve further into these issues.

*People who tend to think of smaller and younger firms as being more financially constrained may be surprised to learn that the tendency of these firms to raise more capital is not unique to 2020.

*Greg Nini is a finance professor at Drexel University, Edie Hotchkiss is a finance professor at Boston College, and David Smith is a finance professor at University of Virginia.*

The Gupta Governance Institute advocates for improved governance practices for public, private and nonprofit organizations.

The Center's research and programmatic efforts advocate for leading governance practices in the public and private sectors.