Incentivizing Financial Regulators

Regulation and Gatekeepers

A researcher at Drexel University’s LeBow College of Business finds a novel link between the organizational design of regulators and their enforcement actions, illustrating that SEC attorneys with stronger promotion incentives engage in tougher enforcement activity.

Key Insights

- Attorneys at the U.S. Securities and Exchange Commission (SEC) are promoted faster when their enforcement caseload is larger. This positive relationship between promotions and enforcement activity is not affected by employee-specific characteristics or region-specific conditions.

- SEC attorneys file complaints against more defendants and pursue more enforcement cases with severe financial misconduct when the monetary incentive to be promoted is higher. Stronger promotion incentives are also associated with more aggressive settlement terms, such as financial penalties and industry bars.

- Overall, the pay structure for employees at the SEC influences how the regulator carries out its duties by affecting the allocation of cases and leading to more robust enforcement.

Summary of Complete Findings

Executive compensation is a critical component of governance in U.S. firms as it can be used to ensure that management acts in the best interest of the shareholders. This study illustrates that pay structures in the public sector can also create powerful incentives for civil servants, therefore affecting the enforcement activities of the SEC, the primary regulator of securities markets.

Every year the SEC files hundreds of enforcement actions that impose significant costs on market participants and deter future misconduct. This study assesses how internal pay and promotion opportunities drive enforcement activity.

The author of this study created a unique and comprehensive dataset of all attorneys who worked at the SEC at any point between 2002 and 2017, using the regulator’s official records. The study focused on attorneys as they are the only employees who sign the court documents. The sample includes 3,178 enforcement actions with an average of 3.3 defendants.

The salary of SEC attorneys consists of three main components, similar to many other federal agencies. The base pay is determined by the attorney’s pay grade, which is capped. A locality pay supplement, which is a fixed percentage determined by the employee’s duty location. A cash bonus, distributed annually at the discretion of the attorney’s supervisors, to reflect high performance. Promotions are to the immediate next pay grade.

The first observation is that there is a significant positive relationship between enforcement and promotion. By participating in at least one enforcement action, attorneys can increase their promotion probability by between 1.6% and 2.1%. This relation is not explained by tenure, past promotions, skills, motivation and other employee-specific characteristics. At any point in time, an attorney who has filed an enforcement action has a 58.1% chance, on average, of being promoted, compared to a 46.4% chance for someone who has not.

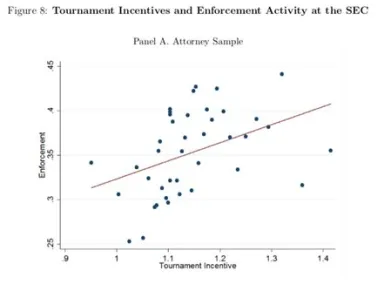

The second observation is that the higher the monetary incentive to be promoted to the next pay grade (measured as the ratio of target salary to current salary, a.k.a. the tournament incentive), the larger the enforcement efforts of that attorney. This relationship is shown graphically in Figure 8 from the study.

The increased enforcement effort includes the number of enforcement actions, the complexity of the case (reflected by the number of defendants) and the severity of the allegations (reflected by parallel criminal proceedings or by alleged violations of anti-fraud provisions). The probability of an enforcement action by attorneys with the 90% highest promotion incentive is 11% higher than the probability of an enforcement action by attorneys with the 10% lowest promotion incentive.

The study also finds that attorneys with larger promotion incentives are associated with more aggressive settlement terms, such as monetary penalties and industry bars. Taken together, the evidence suggests that stronger incentives not only shape the internal case allocation across SEC attorneys, but also lead to more robust enforcement.

In conclusion, according to this study, the law is not enforced by a “faceless bureaucracy” that is unaffected by the way its workforce is organized. By choosing specific pay structures and promotion opportunities, the SEC encourages a clustering of more robust enforcement at the hands of attorneys with stronger promotion incentives.

“Incentivizing Financial Regulators” by Joseph Kalmenovitz (Drexel University), was published in The Review of Financial

Studies, October 2021.

Access paper for subscription holders

Access working paper