Capital Structure

Greg Nini, Associate Professor of Finance at Drexel University’s LeBow College of Business, and coauthors, show that, during the COVID-19 pandemic, firms with the largest shocks to their expected future cash flows raised larger amounts of capital, with equity playing a pivotal role for financially-constrained firms.

Key insights

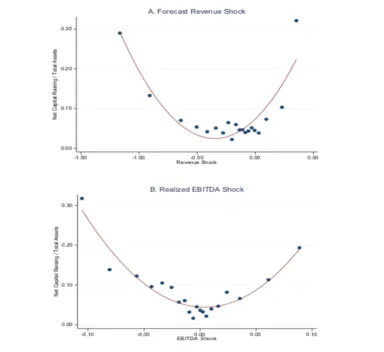

- Capital flows to public firms during the COVID-19 pandemic can help understand how financial markets respond to large exogenous cash-flow shocks. Interestingly, firms with the largest revenue and profitability shocks, both positive and negative, raised the most capital, while firms with small negative or zero shock raised little financing. This observation implies a distinct “U-shaped” pattern in capital raising.

- Firms that are traditionally considered financially-constrained, such as small, young, non-dividend paying and unrated firms, raised more capital than unconstrained firms. Unrated firms raised new capital equivalent to 11.5% of their assets in the first half of 2020, compared to capital raised by rated firms of just under 3% of their assets.

- Equity issuance played a crucial role for financially-constrained firms during the pandemic, while unconstrained firms relied more on the debt markets. Unrated firms raised new equity equivalent to 8.1% of their assets, while rated firms raised, on average, no new equity. This suggests that, at times of large exogenous cash-flow shocks, external equity capital, usually a last resort source of funding, moves up the pecking order.

Summary of Complete Findings

Ensuring that firms are able to raise capital when they need it is a fundamental aim of corporate governance.

The COVID-19 pandemic caused a sharp slowdown in the U.S. economy during the first half of 2020, before snapping back in the second half of 2020. Initially, firms responded by drawing on more than $320 billion from existing revolving lines of credit. This drawdown phase was followed by record levels of capital-raising in bond, loan, and equity markets: in 2020 public companies raised more than $700 billion of new capital between March 23 and June 30, outstripping the average amounts raised over similar months in the previous 10 years, and resulting in the largest increase in corporate cash holdings in 30 years.

This study uses the unprecedented slowdown and record amounts of fundraising during the pandemic to understand better how capital moves across public firms in response to a large exogenous cash-flow shock.

The researchers construct two proxies for the shock caused by the onset of the COVID-19 pandemic. The forecast revenue shock measures the impact of the shock on future expected revenue and captures the effect of early pandemic-related news on longer-term expected cash flows. A second proxy, the realized EBITDA shock, measures the shorter-term realized cash flow impact in the first half of 2020. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is often used to assess a firm’s profitability. In the study, the mean (median) forecast revenue shock is -22.9% (-15.0%). The mean (median) realized EBITDA shock is -0.8% (-0.5%).

First, the study explores whether the amount of capital raised by a firm during the first half of 2020 is related to the size of its cash flow shock. Specifically, the variable under investigation is the net capital raised over a quarter by a firm, calculated as the amount of cash raised from debt and equity less any repayments made to debt and equity holders, normalized by total company assets.

The researchers observe a distinct “U-shaped” pattern in capital-raising: firms that experience large negative shocks raise more capital, as do firms experiencing positive cash flow shocks; instead firms experiencing a small, negative or positive shock raise relatively little financing. More specifically, companies with a positive forecast revenue shock raise capital equivalent to 12.5% of their assets. Companies with a negative shock raise more capital as the shock worsens. On average, companies raise 16 cents of capital for each dollar of reduced expected revenue and $1.14 cents for every dollar lost in realized EBITDA. Figure A and B illustrate the relationship between net capital raised and the size of the shock, as measured by the forecast revenue shock and the realized EBITDA shock respectively.

The study further examines whether firms raised capital as either debt or equity financing. Debt issuance was central to raising capital during the pandemic, particularly among borrowers with a credit rating. Overall, net new debt raised during the first half of 2020 was higher than any other half-year period over the last 30 years. However, it was equity, not debt, that drove the positive relation between the size of the shock and the amount of capital raised, particularly for firms experiencing the largest negative cash flow shocks.

The largest mean cash flow shocks were seen in the oil, coal, and gas (-57.3%), consumer durables (-29.2%), and healthcare (-28.3%) sectors. Except for the oil and gas sector, which had suffered from low oil prices prior to COVID-19, these industries also raise substantial amounts of capital during this period, including a strikingly large amount (24.6% of assets) flowing to the healthcare sector. The healthcare sector stands as an extreme example, where 87% of the large amount of funding takes the form of equity. Equity plays a large role in the funding of other sectors as well, accounting for approximately 40% for several sectors including consumer durables.

When investigating firms that are traditionally considered to be financially constrained, the study shows that they raised larger amounts of capital than unconstrained firms in the first half of 2020. The researchers look at five measures of constraints, including whether a firm paid dividends, had a credit rating, was in the highest tercile of firms sorted by two established indexes of financial constraints, and whether it was in the highest tercile of secured debt holding. Their analysis shows that unrated firms, which constitute 66.4% of the firms in their sample, raised new capital equivalent to 11.5% of their assets, compared to capital raised by rated firms of just under 3% of their assets. Unrated and rated firms both raised debt equivalent to roughly 3% of assets. However, unrated firms also raised new equity equivalent to 8.1% of their assets, while rated firms raised, on average, no new equity. A similar pattern was observed across all measures of financial constraints.

The larger firms raised their net capital predominantly through debt issuance. They repurchased shares and distributed dividends in amounts greater than they raised through new equity issues. In contrast, smaller firms relied more heavily on equity to fund their financing needs. In the study, small and medium enterprises are firms with assets valued at less than $250 million.

Overall, the findings illustrate that U.S. public firms were able to raise external financing during the first half of 2020 to cover expected cash flow shortfalls caused by the pandemic. Consistent with markets allocating funding to those companies with the greatest demand for capital, firms experiencing the largest expected cash flow shocks from COVID-19 raised the most external financing. Most significantly, smaller, younger, and otherwise riskier firms raised significant amounts of capital, mostly in the form of equity.

A question remains as to whether financing was allocated efficiently to the most viable firms (i.e., firms with positive future cash-flow prospects). While it is difficult to distinguish ex ante economically viable firms from zombie firms, the study shows that riskier companies relied more heavily on equity financing. This should reduce concerns related to the use of high leverage, such as debit overhang, for smaller firms.

In conclusion, at times of large exogenous shocks, equity markets can play a critical role in funding firms that are typically perceived as financially constrained. Constrained firms can, in fact, raise more capital than unconstrained firms. This suggests that financing flows to those companies that need it the most, potentially supporting a faster economic recovery.

“The Role of External Capital in Funding Cash Flow Shocks: Evidence From the COVID-19 Pandemic” Edith Hotchkiss (Boston College), Greg Nini (Drexel University), David C. Smith (University of Virginia), March 2022.