The Loan Market Response to Dropdown and Uptier Transactions

A study by Greg Nini, PhD, Associate Professor of Finance at Drexel University’s LeBow College of Business, and coauthor, shows that creditors play an active governance role by adjusting loan contracts promptly to block restructuring tactics of distressed firms if they are perceived to be value-destroying for the firm.

Key insights

- After the 2008 financial crisis, restrictions on borrower activity loosened. Several distressed companies have since claimed the right to issue new debt with priority over first-lien loans. Borrowers have used two main transaction forms, the “dropdown” and the “uptier”, which were made widely known by the recapitalizations of J. Crew and Serta Simmons respectively. These transactions have drawn harsh criticism.

- Within a year after the Serta transaction was announced in 2020, contracts that blocked uptiers nearly doubled as the loan market responded to the perception that this type of transaction is value-destroying for firms.

- Conversely, the J. Crew transaction in 2016 did not trigger contractual changes to block dropdowns, indicating that, for this type of transaction, the benefits for borrowers overweigh the costs to lenders. However, contract terms started to prohibit dropdowns of intellectual property, which is a type of asset that can be easily undervalued.

Summary of Complete Findings

The ability of financially distressed firm to restructure their debt out of court is an important governance issue. Reorganizing debt within a bankruptcy procedure can be costly and cumbersome to a company, but it is widely understood and well structured. An out-of-court recapitalization could provide a more efficient path for a firm to continue to operate and prosper. However, it can be a risky and uncertain process for both creditors and borrowers. This study shows that the loan market responds to recapitalization tactics of distressed firms by adjusting contract terms to optimize the trade-off between the benefits to borrowers and the costs to lenders in out-of-court debt restructuring.

Financially distressed businesses have capital needs to pay operating expenses, invest in capital, retire maturing debts, and so on, but they are unlikely to be able to finance their needs with operating cash flows. Managers of distressed companies often would like to issue debt that has priority over existing claims in order to keep their business open. The researchers investigate two main types of transactions used to issue new debt: “dropdowns” and “uptiers”.

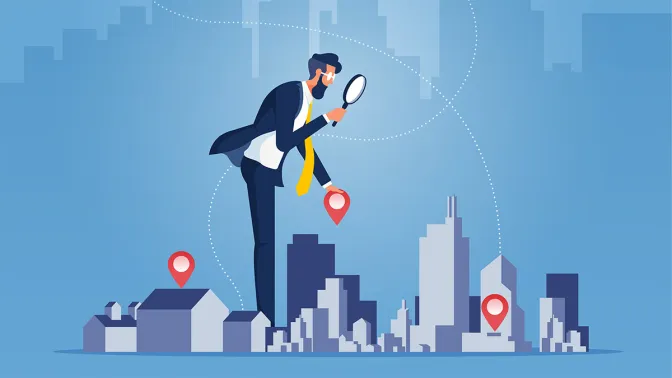

In a dropdown, the borrower moves valuable assets out of its lenders’ collateral package to a so-called “unrestricted subsidiary,” which re-encumbers the assets to support its own newly issued debt. A generic dropdown transaction is illustrated in Figure 1. For the dropdown to be possible, a borrower must be able to transfer a substantial amount of collateral to its unrestricted subsidiaries. The advantage of a dropdown transaction is the ability to issue new debt with priority over pre-existing debt. The pre-existing lenders, however, are left with a subordinated claim on the collateral. The dropdown came to widespread attention in a transaction launched by J. Crew in 2016, although it had been used before. The J. Crew transaction has become a synonym for the dropdown and, more broadly, for aggressive out-of-court recapitalizations.

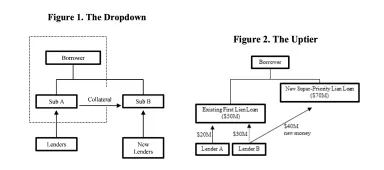

Like the dropdown, the uptier allows a borrower to issue debt. In an uptier, however, no assets change hands, no liens are released, and subsidiaries are irrelevant. The transaction works via a contractual amendment. The borrower persuades a bare majority of lenders, by granting them favorable treatment, to amend the governing loan contract in a manner that explicitly permits the borrower to issue new debt. This is illustrated in Figure 2. Serta Simmons executed an uptier in 2020. Their type of transaction had little precedent.

After the 2008 financial crisis, term loans, traditionally held by the banks that provided a borrower’s revolving credit, were increasingly sold to non-bank institutions. As lenders became more diffuse and renegotiation costlier, restrictions on borrower activity loosened. The study examines the changes to loan contracts after dropdowns and uptiers became a serious risk in 2016 and 2020, with the J. Crew and Serta transactions respectively. These transactions received harsh criticism and triggered litigation.

The researchers analyze the contract terms of a large sample of loans to determine whether borrowers were blocked from undertaking a dropdown or uptier transaction. There could be two main reasons for loan contracts not to be changed. The contractual provisions that permit uptiers or dropdowns could be considered valuable if the benefits to borrowers exceed the costs to lenders. Secondly, contract terms could simply fail to adjust quickly to reflect lender interests, at least in the short term.

The study first finds that after Serta Simmons announced its plan, new loans rapidly adopted terms to prevent borrowers doing likewise in the future. Within a year, the frequency of contracts that blocked uptiers had nearly doubled. This finding clearly shows that the loan markets can be highly responsive to a salient transaction. It also shows that, by blocking uptiers, market participants identified this type of transaction as having a net negative impact on the value of the firm: the loss to creditors outweighed the benefits enjoyed by the borrowing company.

With respect to dropdowns, the study finds that, despite the high salience of the J. Crew recapitalization, contract terms did not adjust to block borrowers from creating (and transferring assets to) unrestricted subsidiaries. This fact, when viewed in light of the way contracts rapidly changed after the Serta transaction, suggests that the utility of allowing unrestricted subsidiaries outweighs the costs to lenders of potential subordination. The researchers conclude that, in some contexts, a borrower’s ability to subordinate lenders can optimize the effectiveness of a loan contract.

The study further highlights that loan agreements introduced terms to block the use of intellectual property as collateral in dropdowns. The different treatment of this type of assets is likely to be explained by the fact that intellectual property is difficult to value and can be easily undervalued. Lenders considered it important to protect it to a higher degree.

In conclusion, even when public opinion cries wolf after aggressive recapitalizations of distressed firms, the loan market can be effective at discerning the trade-offs in contract terms between costs to lenders and value-creation for a firm.

“The Loan Market Response to Dropdown and Uptier Transactions” by Vincent S.J. Buccola (University of Pennsylvania) and Greg Nini (Drexel University).