A Year of Growth — and Planning More — for the Henderson Real Estate Institute

Buildings and skylines all grow from the ground up, and any structure needs a solid base before it can reach the sky.

The foundation is now in place for the Henderson Real Estate Institute (HREI), and over the past year, the Institute’s growth phase has included a 50% increase among students enrolled in courses in real estate management and development (REMD) and a 20% increase in undergraduate students declaring REMD majors or minors.

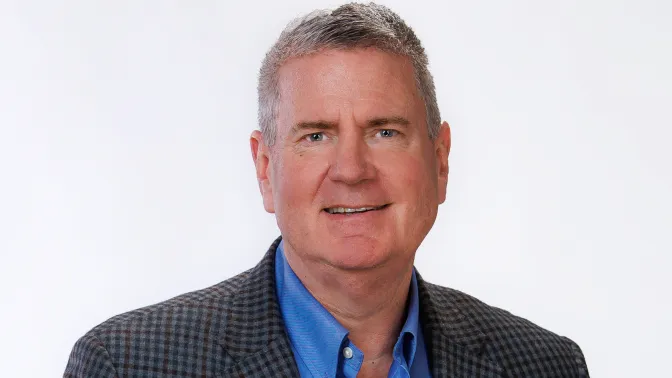

Under the leadership of Carter Murdoch, PhD ‘99, HREI executive director, and members of the HREI advisory board, LeBow’s REMD program is introducing both newly-offered courses and ones with newly revised curricula, including Foundations of Retail Real Estate, Valuation and Forecasting and Real Estate Marketing; the latter two were cross-listing courses with the School of Economics and the Department of Marketing.

Contributions from the advisory board have also expanded REMD course offerings and classroom resources. Among a current roster of adjunct professors who bring extensive industry experience is JD Franklin, former Senior Vice President for Madison Marquette Real Estate Services, who taught Foundations of Retail Real Estate during spring term 2025.

“We study the lease, contract negotiations, vendors, applications and impact of AI – everything for the current era of retail,” he says. “They’re getting exposure to things it took me years to learn.”

Franklin has also lined up guest lecturers from retail-industry leaders like Nuveen and Edgewood Properties, along with LeBow alumni Julie T. Fox, MBA ’05, MS finance ’07, vice president of retail leasing with MCB Real Estate; and Amol Kholi, BSBA finance and marketing ’11, chairman of BRIX Holdings.

John Kjelstrom, who taught Real Estate Valuation and Forecasting during fall term 2025, previously held roles at PwC, National Valuation Consultants and Chatham Financial, along with serving on the board of the National Council of Real Estate Investment Fiduciaries.

In teaching his Valuation and Forecasting course, driven by students’ analysis of companies, funds and individual properties, Kjelstrom says, “I’ve found that students really like the opportunity to think about and experience what the professional world is like.”

Students’ analyses are facilitated by access to real-estate research platform GreenStreet, where students get experience synthesizing real world information to put into a report, valuation software called Argus, the industry-standard for cash-flow forecasting. Licenses for these programs are funded through donations from the HREI advisory board, and students are already citing their hands-on experience in interviews for co-op and full-time roles.

“This course rounds out their training, doing things companies would spend the first months on the job training them how to do,” Kjelstrom says. It really puts them in a position to be really attractive to companies and so they can hit the ground running.“

Outside of the classroom, the HREI advisory board has arranged site visits to projects in development throughout the Philadelphia region, combining on-the-ground insights with access to industry-standard technology to shape their analysis.

This focus on experiential opportunities has been reinforced through Murdoch’s focus on growing the Institute’s Advisory Board and bringing in real estate professionals with a wide range of specialties and areas of focus.

Growth among the board, which nearly doubled in size in 2025, has also spurred increased commitments for hiring students for co-op roles. Among the companies represented on the Advisory Board who will be hiring co-ops for future cycles are Brandywine Realty Trust, Fox Rothschild LLP, Jackson Cross, Marcus & Millichap, Woodward Properties, Altman Management Company, Galman Group and Vanguard Financial.

Kevork Mesrobian, BS information systems ‘06, serves as advisory board vice chair, and in his role as Managing Director, Real Estate at Brookfield, he’s hosted undergraduate students on the annual REMD trip to New York City and created other opportunities for students to gain exposure to industry professionals.

As a board member for five years and a member of the board’s Curriculum subcommittee, Mesrobian takes pride in both the number of new course offerings and the growth in student enrollment. Beyond those classroom innovations, though, he’s even happier with Murdoch’s vision for the institute and dedication to enhancing students’ professional development.

“We’ve really diversified the board in terms of specific disciplines within the field,” he says. “That has led to more touchpoints, exposure and professional guidance for our students in areas like asset management, construction and valuation.”