A Growth Opportunity: Stamatakis Center for Alternative Investments Gathers Academic and Industry Expertise to Benefit Students

Alternative investments — once the domain of institutional investors in a global market of $30 trillion — are now more accessible than ever to individuals due to recent regulatory changes.

With the expansion of investment vehicles beyond publicly-traded, federally-regulated markets, there is a growing need for both current and aspiring practitioners to master the opportunities and risks inherent in venture capital, private equity, private credit and other alternative assets in private markets.

The launch of the Stamatakis Center for Alternative Investments at the LeBow College of Business brings together investment professionals, academic researchers and students who will become the next generation of advisors and managers to explore and study the alternatives space, chart its growth and project the paths it might take.

Established through a generous gift by longtime Drexel supporter and former Drexel Trustee Manuel “Manny” Stamatakis, the Center is dedicated to advancing a deep and comprehensive understanding of the markets for alternative investments.

“Alternative investments are reshaping the capital markets of the 21st century,” Stamatakis says. “I am happy that this Center ensures Drexel students are learning alongside the people who shape these markets from faculty experts.”

Leveraging Drexel’s experiential learning model and LeBow’s strong network of alumni working in private markets, the Center will offer LeBow students advanced knowledge and real-world exposure to this critical and rapidly evolving sector of the U.S. and global economies.

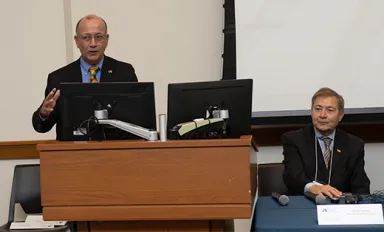

“Having the Stamatakis Center at LeBow is an exciting development, and I look forward to the valuable opportunities it will bring to our students, faculty and the broader Drexel community as they benefit and learn from experts in this dynamic segment of the financial sector,” says Vibhas Madan, PhD, LeBow Dean and R. John Chapel Jr. Dean’s Chair.

Dean Emeritus and George B. Francis Professor of Finance George Tsetsekos, PhD, will serve as the Center’s inaugural Executive Director and oversee key initiatives, including the development of a simulation game that mirrors the workings of alternative investment markets and the fostering of research collaborations between LeBow faculty and industry practitioners.

Tsetsekos compares the new Center to the long-standing Dragon Fund, a portion of the University’s endowment managed by students enrolled in courses on investment portfolio management.

“We started the Dragon Fund when I was dean, and it has provided students invaluable, hands-on experience in portfolio management for more than 20 years,” he says. “Now, the alternatives space is offering similar opportunities for a different group of vehicles, and students looking to pursue careers in investment management and private markets will have to be knowledgeable about this area.”

In addition to research activity and creating and integrating the newly developed simulation into finance curriculum, the Center will host symposia, forums and conferences featuring prominent academic and industry leaders and organize career panels and mentorship opportunities for students pursuing jobs in the alternatives space.

Ultimately, the Center will be a hub for knowledge in private capital space with the capacity to grow as the alternatives market and all that surrounds it — financing structures, deal flow, regulatory frameworks and more — continues to evolve.

“The financial supermarket, as I like to put it, has expanded beyond a standard range of choices that involve public securities,” Tsetsekos says. “Increased choice, along with greater access by individual investors, requires a closer look at the ingredients — namely, risk and return.”

The new Center will be housed in LeBow’s Department of Finance, and as it grows, it will expand its activities to include collaboration with the Chartered Alternative Investment Analyst (CAIA) Association and the formation of a student club focused on alternative and venture investing.