Where is the U.S. Economy Headed? Policy Experts Weigh in at Inaugural Drexel Economic Forum

Strange, contradictory signals persist in the U.S. economy: stubborn inflation, stock markets at or near record highs, low levels of consumer confidence. Investors, policymakers and consumers are all seeking certainty.

The time is ripe for some analysis — what’s really going on? The inaugural Drexel Economic Forum, hosted in Gerri C. LeBow Hall by the School of Economics, put forth some answers from a range of policy policymakers and academic experts.

This gathering leveraged longtime strengths in the School of Economics around global trade and macroeconomics, as well as expertise at the University’s highest levels: LeBow Dean Vibhas Madan, PhD; University Provost Paul Jensen, PhD; and Drexel President Antonio Merlo, PhD, are all economists by training.

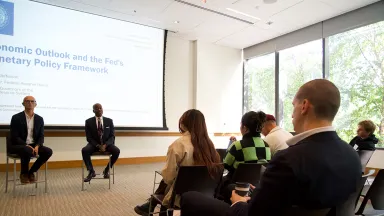

The Forum’s highlight was a keynote address by Philip Jefferson, PhD, vice chair of the federal reserve. Following introductions from Dean Madan and from forum organizer and Professor of Economics Andre Kurmann, PhD, Jefferson shed some light on the Fed’s outlook and its decision-making process.

He highlighted his support for the Federal Open Markets Committee’s recent reduction in the federal funds rate without indicating whether the committee will proceed with a further reduction at its next meeting.

“I don’t think of policy as being meeting-by-meeting — I always think of about being on a path of policy,” Jefferson says.

He acknowledged that current economic trends may put the Fed’s two congressionally mandated goals — supporting maximum employment in the labor market and reducing inflation — at odds.

He also addressed additional uncertainty surrounding the current availability of economic data. The Forum fell on the first Friday on the month – typically the day when the Bureau of Labor Statistics’ jobs report is released — but the shutdown of the federal government prevented the release of the September jobs report.

Jefferson called the ongoing situation “less than ideal,” while noting, “I rarely focus on a single report.”

“There’s a whole constellation of data that affects my take on the economy,” he says. “I feel I have enough information to do our job.”

Ella DiSimone, a fourth-year student majoring in economics and mathematics, asked Vice Chair Jefferson during a Q&A session after his address.

“I asked about the target rate of inflation of 2 percent and if that goal is sustainable going forward,” she says. “I appreciated the thoughtful and articulated language he used. His response was not overcomplicated, and focused on the necessary factors that have impacted the rates of inflation.”

Other Forum presenters gave their perspectives from outside of government on the potential paths for the U.S. economy in the near term.

Greg Ip, chief economics commentator for the Wall Street Journal, shared ideas that he’s tested out in his Capital Account column, and Ernie Tedeschi, director of economics with the Budget Lab at Yale University, delved into the effects of recent legislation, growing federal debt and tariff policy.

Ioana Marinescu, PhD, associate professor at the University of Pennsylvania’s School of Social Policy & Practice, shared a range of academic publications and survey data that attempt to quantify generative AI’s impact on the labor market. Studying past innovation and disruptive technologies, including the advent of personal computing and high-speed internet access, while also demonstrating the limit of innovation to improve lives and efficiency beyond a certain threshold.

My Nguyen, a fifth-year undergraduate student majoring in economics and mathematics, attended the Forum in hopes of asking Vice Chair Jefferson a question.

“His response, about shifting post-COVID priorities and keeping an eye on new data rather than assuming inflation remains the main risk, was really insightful,” she says.

“Overall, the forum was a great mix of academic and policy-focused discussion, and I left with a better sense of how these different perspectives connect.”