LeBow News & Events

Connect with Us

Thank you for your interest in the Howley Finance Academy. We look forward to hearing from you.

An immersive business education designed for the driven and determined.

Admissions experts with one goal – to help you soar like a Dragon.

Expert faculty solving tomorrow’s problems today through cutting-edge research.

Companies turn to LeBow for partnership, solutions and the next generation of leaders.

Launched in 2025 through the generosity of W. Nicholas Howley ’75 and The Howley Foundation, the Howley Finance Academy is a selective program designed to prepare LeBow undergraduate students for careers at top firms in private equity, investment banking and private markets.

Through custom coursework, programming and engagement with industry professionals and alumni, students sharpen their quantitative skills, build advanced knowledge of market fundamentals and gain practical experience. The Academy equips participants to stand out in co-op, internship and full-time roles.

The Academy will better position Drexel students to compete for top jobs in the financial sector and, ultimately, create a track record of Drexel graduates working and thriving in private equity and investment banking.

Students accepted into the Academy join a cohort-based experience that extends through graduation. Components include:

Custom sections of finance courses, including:

Each year, a select group of high achieving LeBow undergraduates are selected to join the Howley Finance Academy. Admission is competitive, with up to 20 students selected for the Academy’s second cohort and opportunities for growth as the program continues to expand.

The Howley Finance Academy provides students with a competitive advantage in the most selective areas of finance.

Howley Finance Fellows:

Students selected for the Academy are recognized as Howley Finance Fellows. Those who demonstrate exceptional performance and leadership may be invited to apply for the distinction of Howley Finance Senior Fellow.

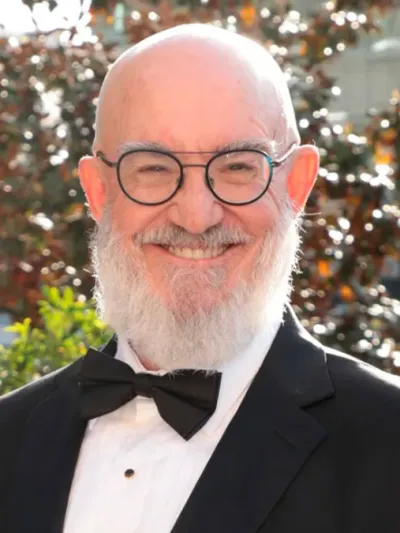

Co-Founder and Chairman

TransDigm Group

Nick Howley ’75 and family founded The Howley Foundation to provide access to quality education for talented students lacking financial means.

Read moreThank you for your interest in the Howley Finance Academy. We look forward to hearing from you.